Diversification among appropriate and understood classes of investments is essential for a safe and healthy investment profile in your life, and that of your family.

Productivity

It makes the world go ‘round.

Collaboration

Projects and ideas that have potential can be very engaging and inspiring, drawing from our affinities and skill sets.

Management

Taking responsibility to oversee the decision-making and structural opportunities of managing money and people.

Asset Classes for Investing

Equities

Skill: 1

Skill: 1  Liquidity: 10

Liquidity: 10

Equity investment is buying shares directly from companies or other individual investors with the expectation of earning dividends or reselling the same to make gains when the prices are high. An investor buys the shares on a stock exchange market while trading at a lower price. They monitor the shares’ performance at the stock market, and when the share price goes up, they sell them at a profit. Equities bring about more diversification in the asset allocation of a portfolio.

Real Estate

Skill: 10

Skill: 10  Liquidity: 3

Liquidity: 3

When you think about real estate investing, the first thing that probably comes to mind is your home. Of course, real estate investors have lots of other options when it comes to choosing investments, and they're not all physical properties. MORE...

Companies

Skill: 10

Skill: 10  Liquidity: 1

Liquidity: 1

Private companies are owned wholly by the founders or employees of the company, and shares of its stock are not traded on public markets. Investing in private companies requires buying private shares of equity directly from the company, and it may have a high minimum investment. You will need to have access to key personnel within the company (such as the owner, or investor relations team), or have access to equity shares through a crowdfunding platform.

Mortgages

Skill: 3

Skill: 3  Liquidity: 4

Liquidity: 4

A Mortgage Investment Corporation (MIC) provides a way to invest in the real estate market, mitigating the time and risk of investing in individual mortgages. Investors pool their money by buying shares in a MIC, creating an alternative fixed-income investment.

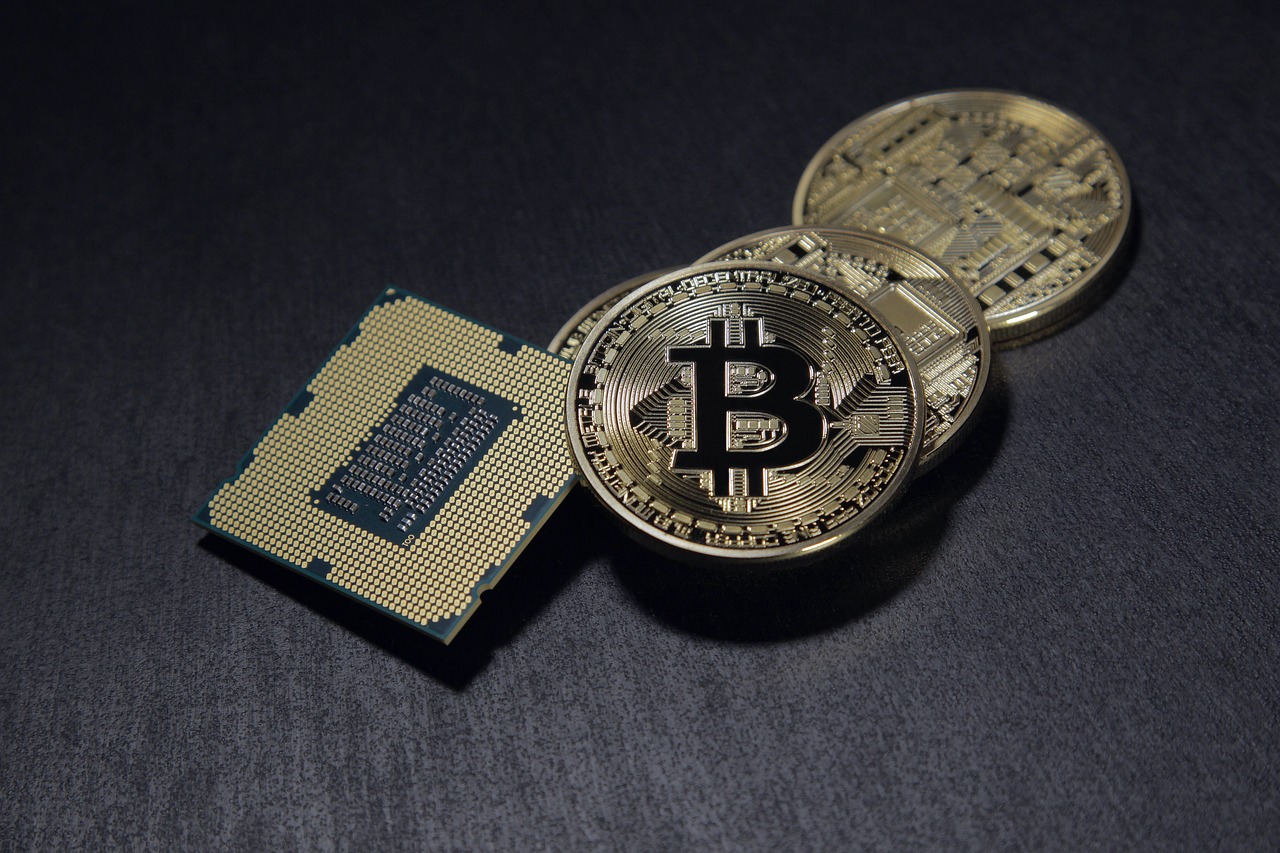

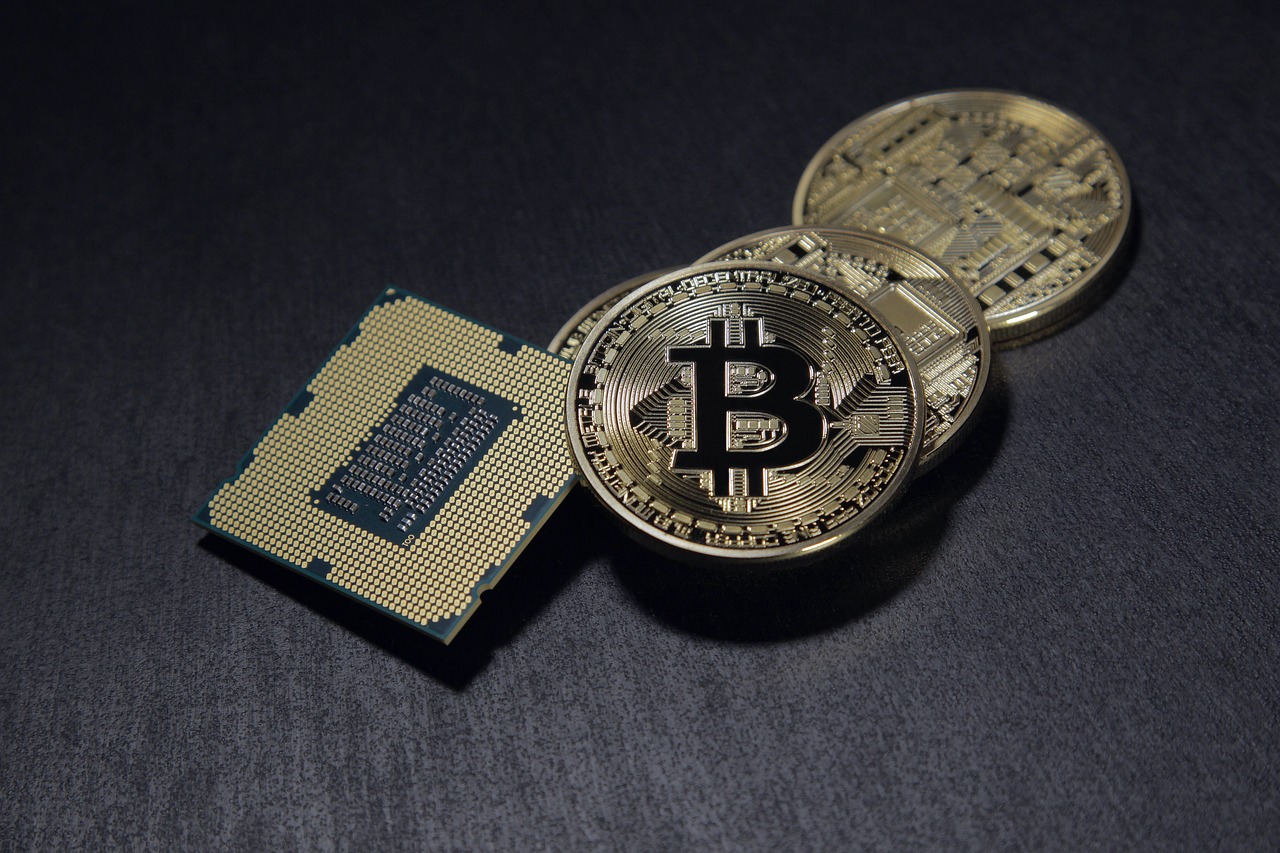

Crypto Assets

Skill: 10

Skill: 10  Liquidity: 10

Liquidity: 10

When you think of investing in cryptocurrency, you might think about buying and holding one or more crypto coins on a whim. Do not do this, or be prepared to lose your cash. Buying cryptocurrency directly is probably the most common way to add crypto exposure to your portfolio, but when it comes to investing in cryptocurrency, you have a few different options.

Royalties

Skill: 5

Skill: 5  Liquidity: 5

Liquidity: 5

A royalty company provides fundings to miners in exchange for a share of production revenues. Investors can either invest directly in a commodity, a company that mines them or turn to a royalty company that owns royalties on that specific commodity or commodities. A royalty company, therefore, stands between the commodity and the miner – and offers the least amount of exposure to risks directly in the commodity or the miner.

Commodities

Skill: 10

Skill: 10  Liquidity: 7

Liquidity: 7

Commodities are raw materials that are either consumed directly, such as food, or used as building blocks to create other products. There are several ways to consider investing in commodities. One is to purchase varying amounts of physical raw commodities, such as precious metal bullion. Investors can also invest through the use of futures contracts or exchange-traded products (ETPs) that directly track a specific commodity index. These are highly volatile and complex investments that are generally recommended for sophisticated investors only.

Startups

Skill: 10

Skill: 10  Liquidity: 1

Liquidity: 1

Investing in startup companies is a very risky business, but it can be very rewarding if and when the investments do pay off. The majority of new companies or products simply do not make it, so the risk of losing one's entire investment is a real possibility. The ones that do make it, however, can produce very high returns on investment. MORE...

Currencies

Skill: 7

Skill: 7  Liquidity: 10

Liquidity: 10

Forex (FX) refers to the global electronic marketplace for trading international currencies and currency derivatives. It has no central physical location, yet the forex market is the largest, most liquid market in the world by trading volume, with trillions of dollars changing hands every day. Most of the trading is done through banks, brokers, and financial institutions.

Futures

Skill: 8

Skill: 8  Liquidity: 10

Liquidity: 10

A futures market is an auction market in which participants buy and sell commodity and futures contracts for delivery on a specified future date. Futures are exchange-traded derivatives contracts that lock in future delivery of a commodity or security at a price set today. MORE...

We do not provide financial management or investment advice. No information contained within or externally linked should be taken to constitute an endorsement or predict future performance of any business venture or investment opportunity. Invest at your own risk.

Learn at investopedia

DIVERSIFICATION

Nothing can be overstated about the importance of dividing risk, and not putting all-in your eggs into one or a few baskets. You will learn this the hard way. Then, as you refine your emotions and techniques for assessing what ‘good ideas’ are, you will find that you want to enable a variety of investment approaches, time horizons, risk profiles, and industries into which to carefully place your positions. The overall quality of your research, judgment and actions will accumulate to a portfolio of success upon which you can rely for a balance of cash-flow and capital appreciation over the years it will take to learn and get traction.

learn more